As leaders in the food industry, it is important to make informed decisions about your sourcing practices. The surge in Russian pea imports to China is a seismic shift for the pea protein market. This trend, while seemingly isolated, poses a potential threat to some of the key sustainability and marketing claims prevalent in pea-based products. With competitive pricing and vast production capacity, Russia’s aggressive steps have led to a changing of the global trade flows of peas.

What changed?

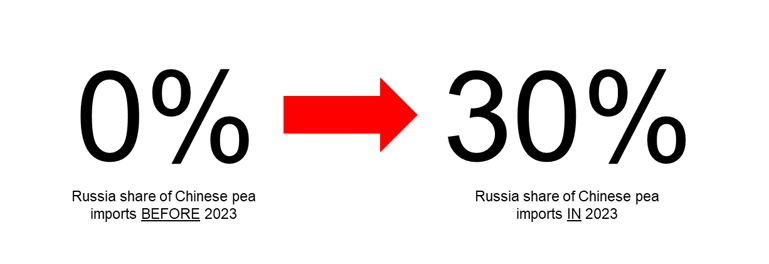

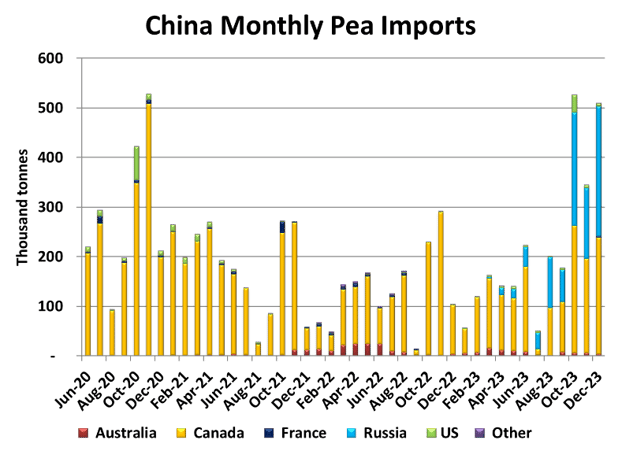

In 2022 China approved the phytosanitary protocol for Russian peas, opening the door for Russia to start supplying this major market. Prior to 2023, Canada was the largest supplier of peas by far, importing as much as 95% of the total peas into China. In 2023, the first peas started flowing from Russia into China and grew from 0% to 30% of total shipments within the single year. In the last quarter of 2023, Russia accounted for nearly 50% of pea imports into China, demonstrating the speed at which Russia has taken market share.

In 2024, China has also approved a phytosanitary protocol allowing for the import of peas from Ukraine. Russia and Ukraine are large pulse growing regions, harvesting over 3.4 million tonnes of peas in 2023.

While the impact is being felt in the Canadian pea market already, the impact to US growers is small due to the small share (<2%) of peas that the US supplies to China historically.

Data provided by LeftField Commodity Research

How will this impact your brand’s sustainability claims and consumer trust?

- Marketing Claims at Risk: China uses pea for animal feed and food uses, namely starch and protein processing. Most brands sourcing pea protein from China have been able to claim that the protein is “Made from North American Peas” due to the large market share of Canadian pulses into China. With Russia and Ukraine fighting for (and starting to take!) a majority stake in the supply, that claim will no longer ring true.

- Changes to Scope 3 Emissions: North American peas are some of the most sustainably grown crops on the planet! Due to the high adoption of no/low tillage, nitrogen fixation, and rain fed farming in the North American plains, these peas have some of the lowest carbon footprint of all peas grown globally, especially compared to peas grown in Russia. Knowing where the peas come from is critical to understanding the Scope 3 emissions of a finished food product.

What can you do to help build a better food future?

- Join us in advocating for sustainable and ethical sourcing practices in the pea protein industry.

- Don't wait until it's too late. Act now to secure your supply chain and maintain your brand's commitments.

Lastly, chat with us today to discuss your sourcing options and the changing landscape of pea protein.